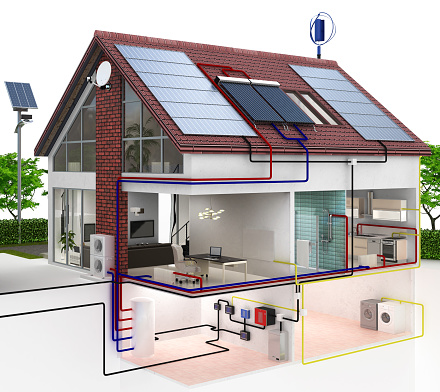

Low-energy house - cut out with solar installation - 3d visualization

Are you looking to save money on your energy bills while taking advantage of flexible financing options? If so, an energy efficiency mortgage (EEM) could provide the perfect answer. An EEM can help you make key home improvements that reduce your energy costs and allow you to tailor your loan repayment schedule.

Whether it’s updating windows, adding insulation, or installing a new furnace, an EEM can be just what you need to get the job done right and create a more comfortable, efficient home - all with minimal financial risk. Read on for 6 great reasons why an Energy Efficiency Mortgage may be the best solution for homeowners like yourself who are looking for clever ways to finance their next home improvement project!

1.

The Benefits of an Energy Efficiency Mortgage

Implementing energy efficient upgrades in a home not only reduces energy bills, but also helps combat climate change. However, the upfront cost of these upgrades can be daunting for many homeowners. This is where an Energy Efficiency Mortgage (EEM) can help.

An EEM is a mortgage that allows borrowers to finance the cost of energy efficient upgrades as part of their mortgage. These upgrades can range from new insulation to solar panels. The benefits of an EEM are numerous: reduced energy bills, increased comfort in the home, improved indoor air quality, and an increase in the home’s value.

In addition, many borrowers may qualify for a larger loan amount due to the increased value of their energy efficient home. Overall, an EEM is a smart investment for homeowners looking to reduce their environmental impact and save money in the long-run.

Low energy house symbol - 3d visulization

2.

How an EEM can Reduce Your Energy Bill

Energy Efficient Mortgages (EEMs) could be the key to reducing your energy bill and making your home more eco-friendly. An EEM is a type of mortgage that finances energy-efficient upgrades, such as new windows, insulation, or HVAC systems.

The upgrades should help you save money on utility bills while also reducing your carbon footprint. Many homeowners are hesitant to make these upgrades due to the upfront costs, but an EEM can make it more accessible by providing specialized financing options.

In addition to reducing your energy bill, these upgrades can also increase your home's value and make it more attractive to buyers if you decide to sell in the future. An EEM is an excellent investment that can benefit both your wallet and the environment.

3.

Financing Options for an EEM

When it comes to financing options for an Energy Efficient Mortgage (EEM), there are a variety of avenues to explore. EEMs allow borrowers to finance energy-efficient improvements to their home, which can lead to lower utility bills and a more comfortable living space.

One option is through a conventional loan, which can be obtained through a bank or other lending institution. Another option is through a government-backed loan, such as an FHA or VA loan. These loans often have more flexible qualification requirements and can offer lower down payments.

Additionally, some states and local governments offer programs specifically tailored to financing EEMs. Exploring all of these options can help ensure that borrowers find the right financing solution for their needs.

Rear view of dad holding her little girl in arms and showing at their house with solar panels.Alternative energy, saving resources and sustainable lifestyle concept.

4.

Tax Savings Through an EEM

Did you know that you can save money on your taxes by using an Energy Efficient Mortgage (EEM)? EEMs are designed to help homeowners finance energy-saving improvements to their homes. The interest on the EEM portion of the loan is tax-deductible, which can provide significant savings, especially for homeowners who make large energy-saving improvements.

In addition to tax savings, EEMs can also help homeowners save money on their monthly energy bills and increase the value of their homes. If you're interested in exploring the benefits of an EEM, it's important to work with a qualified lender who can help you navigate the process and find the best option for your unique circumstances.

5.

Ways to Improve Your Home's Energy Efficiency

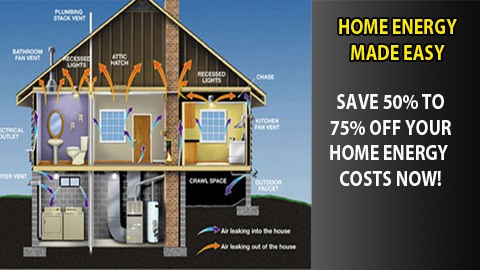

Improving your home's energy efficiency not only saves you money on your utility bills, but it also helps to reduce your carbon footprint. Some simple ways to increase your home's energy efficiency include upgrading to energy-efficient appliances, sealing air leaks around doors and windows, adding insulation to your walls and attic, and replacing old incandescent light bulbs with LED bulbs.

Additionally, installing a programmable thermostat and using it to adjust your home's temperature when you are away or asleep can save you up to 10% on heating and cooling costs. By taking these steps, you can make your home more comfortable and sustainable for years to come.

New residential house in USA with roof covered with solar panels for producing of clean ecological electricity in suburban rural area. Concept of investing in autonomous home for energy saving.

6.

Qualifying for An EEM Loan

Qualifying for an EEM loan can be a great option for those looking to make energy-efficient improvements to their homes. Unlike traditional loans, an EEM loan takes into account the energy savings that the upgrades will bring and can provide up to 100% financing for these improvements.

To qualify for an EEM loan, borrowers must go through a thorough home energy audit to determine which upgrades are necessary and will provide the most savings. This audit also helps lenders determine the overall energy efficiency of the home and calculate the potential savings.

With an EEM loan, homeowners can not only save money on their energy bills but also contribute to a greener future.

Energy efficiency mortgages offer a great way to make your home more eco-friendly, as well as more affordable. An EEM can help you finance both the cost of energy efficiency improvements, and the cost of interest on your loan.

It's important to understand all the nuances involved in getting an EEM loan, such as the qualifying requirements, financing options available to you, tax savings you can take advantage of and the different ways you can improve your home's energy efficiency.

With an EEM in place, not only will you be able to drastically reduce your energy bill each month, but also reduce your carbon footprint and make a positive impact on the environment. Plus, less money out of pocket!